Covered Calls Made Simple: A Practical Guide

When most people think about investing, they imagine buying stocks and waiting for their value to rise. But appreciation isn’t the only way to make money from the stocks you own. Many investors are looking for ways to generate steady income on top of holding their long-term positions.

One of the most popular and disciplined methods to achieve this is the covered call strategy. While options can seem complex, covered calls are among the simplest to understand and apply. This guide will walk you through the basics in plain language - showing how the strategy works, why people use it, what you need to keep in mind and why we choose it to be a starting point of ThetaEdge.

What is a Covered Call?

A covered call is an options strategy where you sell a call option on a stock you already own. In return, you collect a premium - essentially income paid to you upfront.

Think of it like renting out your stocks. You still own them, but you’re agreeing to sell them at a set price (the strike price) if the buyer chooses to exercise their option. If they don’t, you keep both your shares and the premium.

This approach is considered conservative compared to many other options strategies, because it starts with ownership of shares and focuses on income rather than speculation.

Why Modern Investors Use Covered Calls

Covered calls have become a go-to strategy for income-focused investors because they:

- Generate regular income: You collect option premiums, often monthly or quarterly.

- Work well in sideways markets: Even if the stock doesn’t move much, you still earn income.

- Enhance total returns: You can potentially earn more than just relying on dividends or appreciation.

- Add discipline: By choosing strike prices thoughtfully, you create a structured approach to trading.

Of course, there’s a trade-off: if your stock jumps significantly higher, your upside is capped at the strike price you agreed to sell at.

Step-by-Step Practical Walkthrough

Here’s how a covered call typically works:

Step 1: Own the stock You need at least 100 shares of a stock to sell one standard call option contract.

Step 2: Pick a strike priceDecide the price at which you’d be willing to sell. A higher strike price means less income but more room for growth; a lower strike price means more income but less upside.

Step 3: Select an expiration dateOptions expire on a set date. You can choose shorter terms (like one month) for frequent income or longer terms for fewer trades.

Step 4: Sell the call optionOnce you sell the option, you receive the premium immediately. This is your income, regardless of how the stock moves.

Step 5: Manage the outcome

- If the stock stays below the strike price → the option expires worthless, and you keep both your shares and the premium.

- If the stock rises above the strike price → your shares may be “called away” (sold at the strike), and you still keep the premium.

Example:

Imagine you own 100 shares of XYZ at $50. You sell a one-month call with a strike at $55 for $2 per share. You immediately collect $200. If the stock stays below $55, you keep your shares and the $200. If the stock rises above $55, you sell your shares at $55 but still keep the $200 premium.

Risks and Considerations

While covered calls are simple, they aren’t risk-free. Some key points to remember:

- Capped upside: If the stock rallies far above your strike price, your gains are limited.

- Stock ownership risk: If the stock drops in value, the premium may not offset your losses.

- Share requirements: You need at least 100 shares to write a contract, which can be a high entry point for some investors.

- Active management: Success comes from consistency and discipline - not guessing market moves.

Covered calls reward patience and clarity. They’re best suited for investors comfortable with exchanging unlimited upside for steady, predictable income.

Simplify Your Options Income Strategy with ThetaEdge

Turn Your Portfolio into a Consistent Income Stream

If you're holding long-term stock positions and looking for ways to generate additional income without day trading or constant market monitoring, covered calls might be your answer. But let's face it, managing covered call strategies can be complex, time consuming, and overwhelming. That's where ThetaEdge comes in.

How ThetaEdge Makes Covered Calls Simple

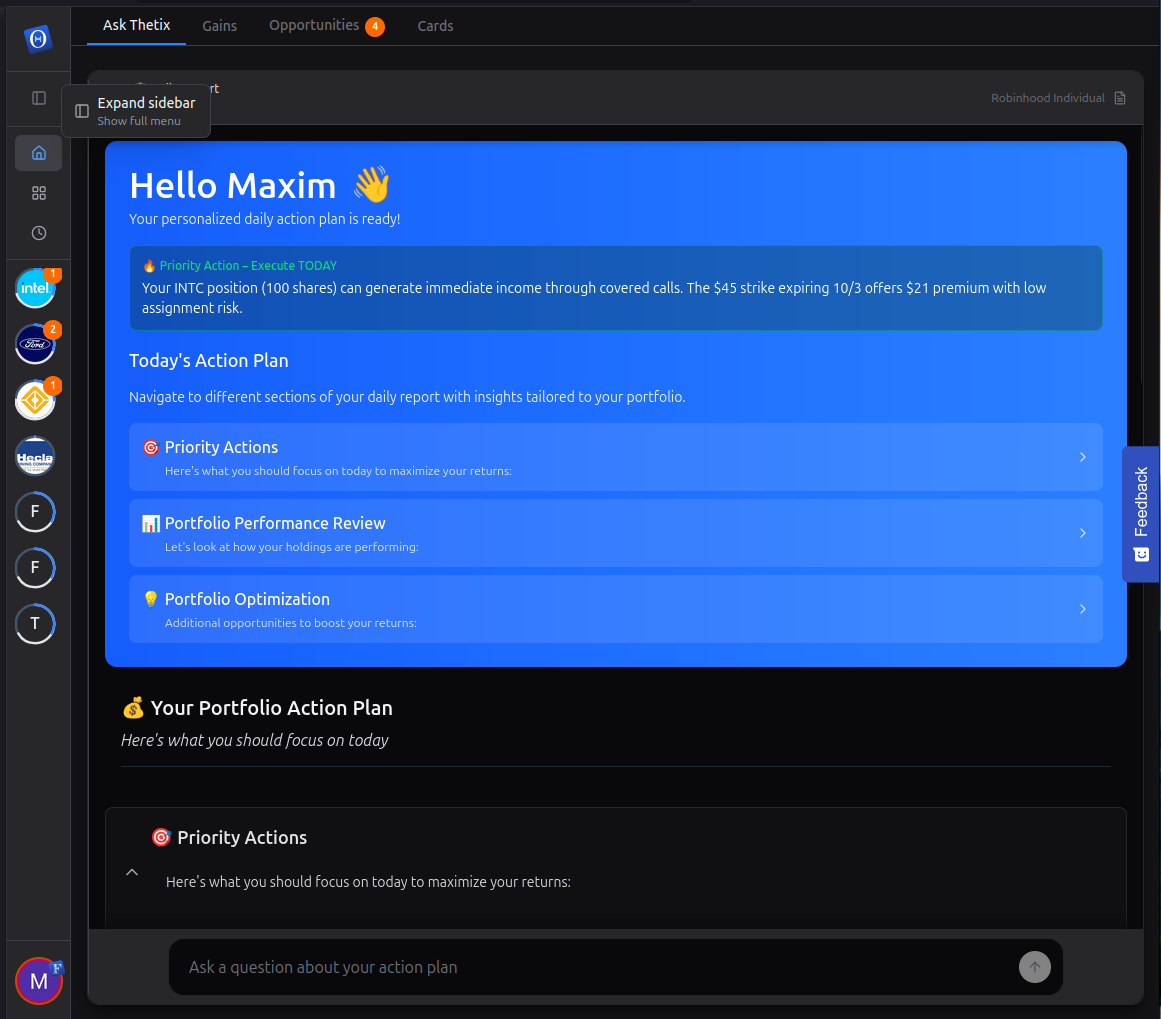

Personalized Opportunities, Daily

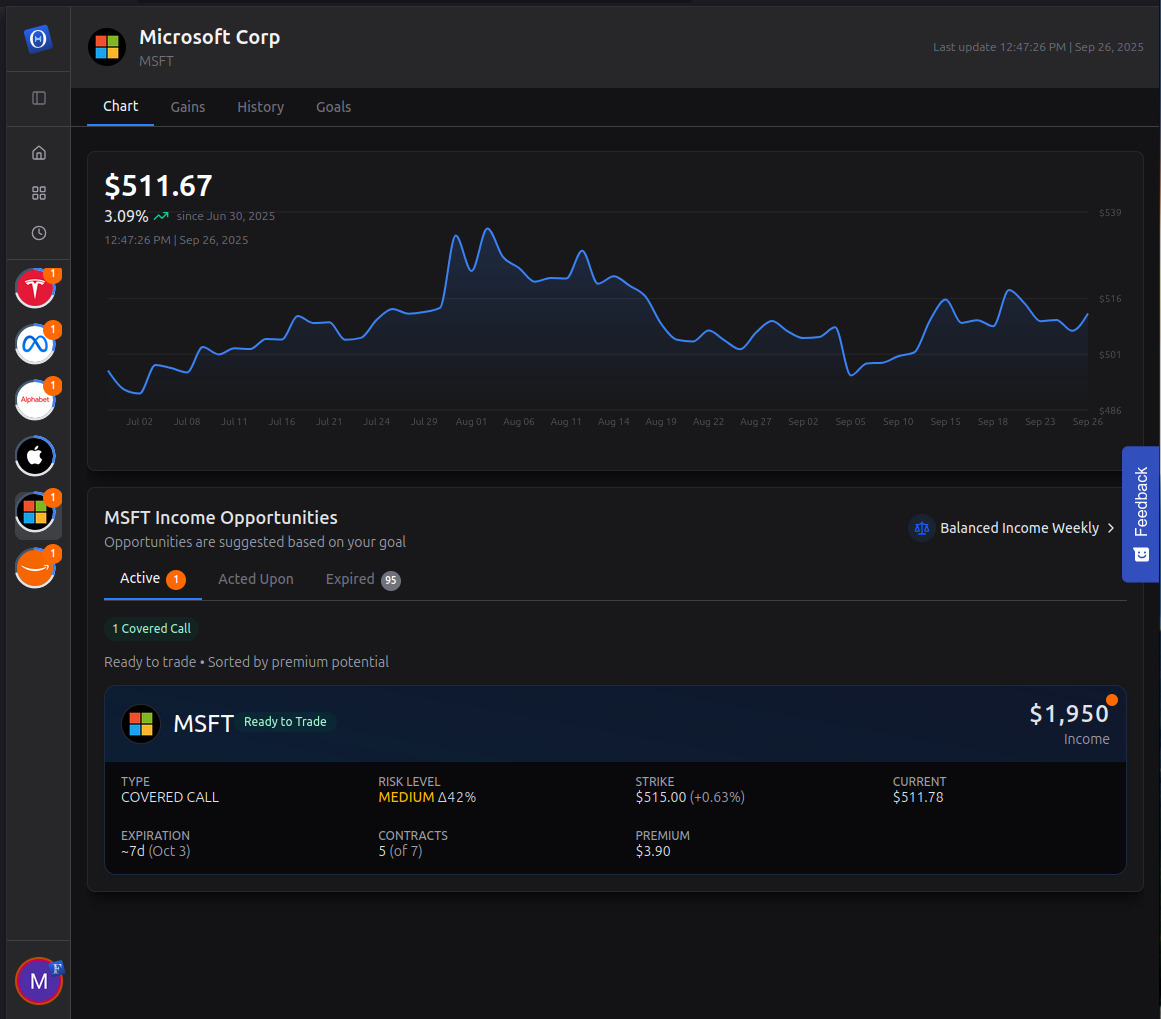

ThetaEdge transforms the complex world of covered calls into a streamlined, accessible strategy. Our platform analyzes your existing portfolio and delivers tailored covered-call opportunities that match your specific holdings and risk tolerance. No more spending hours researching strike prices, expiration dates, or calculating potential returns, we do the heavy lifting for you.

Every day, you'll receive fresh opportunities based on real-time market conditions. You control your risk level through customizable settings, ensuring that every suggested trade aligns with your investment goals and comfort zone.

Seamless Execution and Management

Once you identify an opportunity you like, ThetaEdge doesn't leave you on your own. The platform continuously monitors your positions and proactively alerts you when action is needed. Whether it's time to roll a position to capture more premium or close out a trade to protect your gains, you'll receive timely notifications with clear, actionable guidance.

For users with supported brokers like E*Trade, you can execute trades directly within ThetaEdge, no switching between platforms, no manual order entry, just seamless integration that saves time and reduces errors.

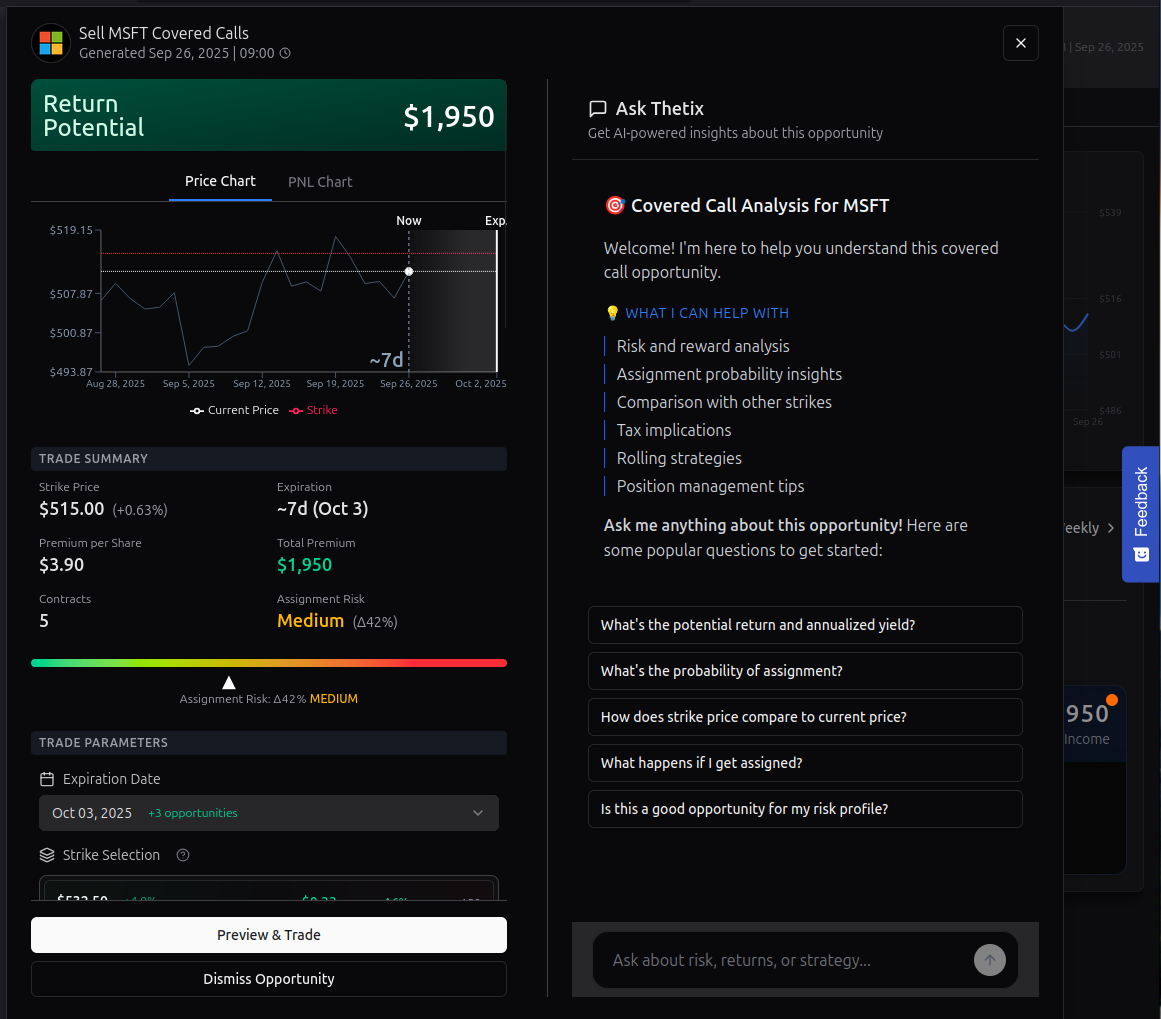

Meet Thetix: Your AI-Powered Trading Assistant

Plain English, Powerful Insights

Gone are the days of deciphering complex options terminology or wrestling with confusing Greeks. Thetix, our specialized AI assistant, speaks your language. Ask questions in plain English like:

- "What's my risk if I sell this covered call?"

- "How does strike price compare to current resistance levels?"

- "What's the probability this call expires worthless?"

- "Should I roll my MSFT position?"

Thetix provides clear, actionable answers backed by comprehensive market analysis, helping you understand not just what to do, but why.

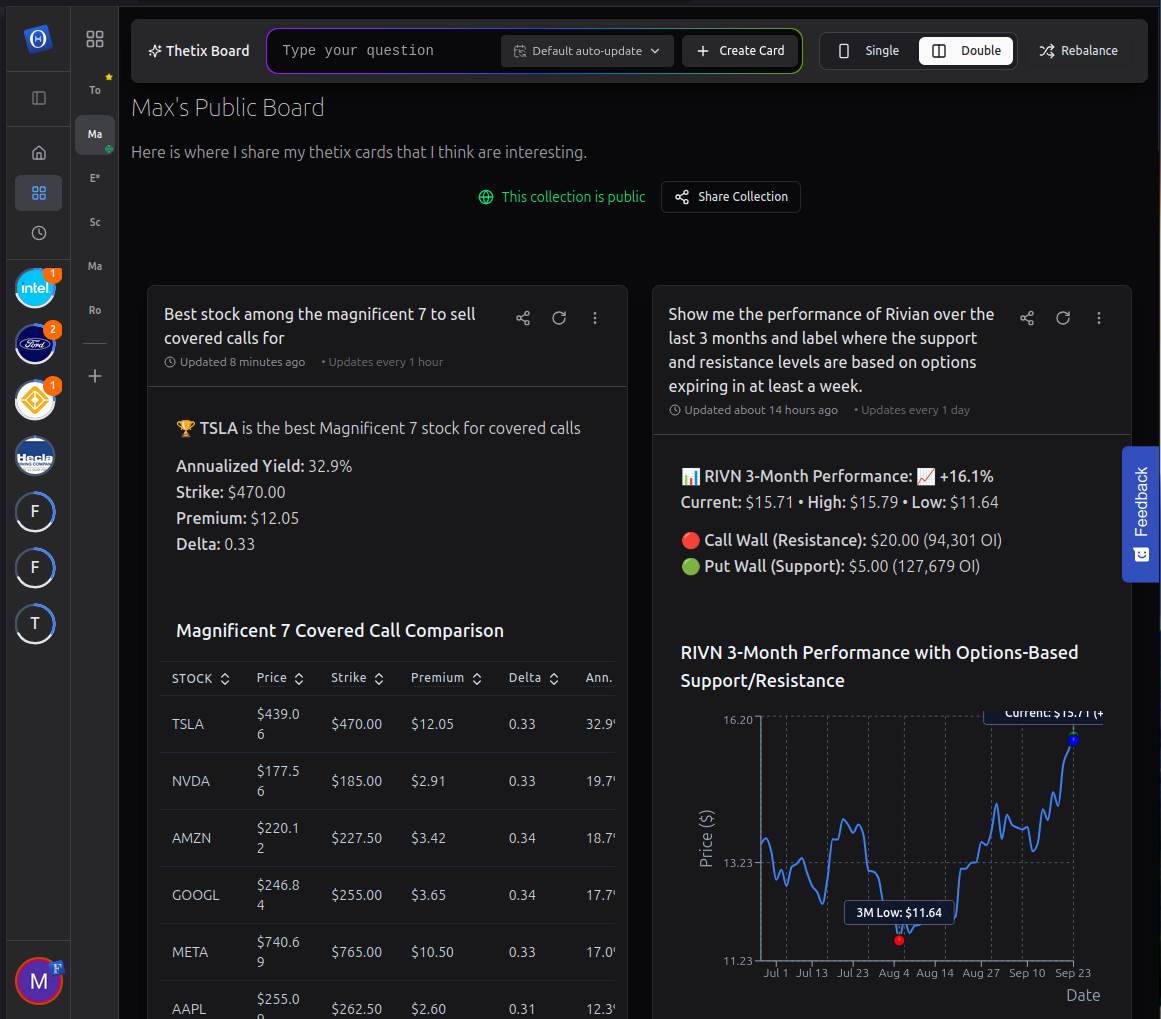

Custom Dashboards at Your Fingertips

Beyond answering questions, Thetix helps you build sophisticated, personalized dashboards that display exactly the information you need. Track assignment probabilities, compare strikes across multiple positions, monitor tax implications, or analyze rolling strategies, all in a visual format that makes complex data instantly understandable.

Track Your Success with Comprehensive Income Analytics

See Your Real Returns

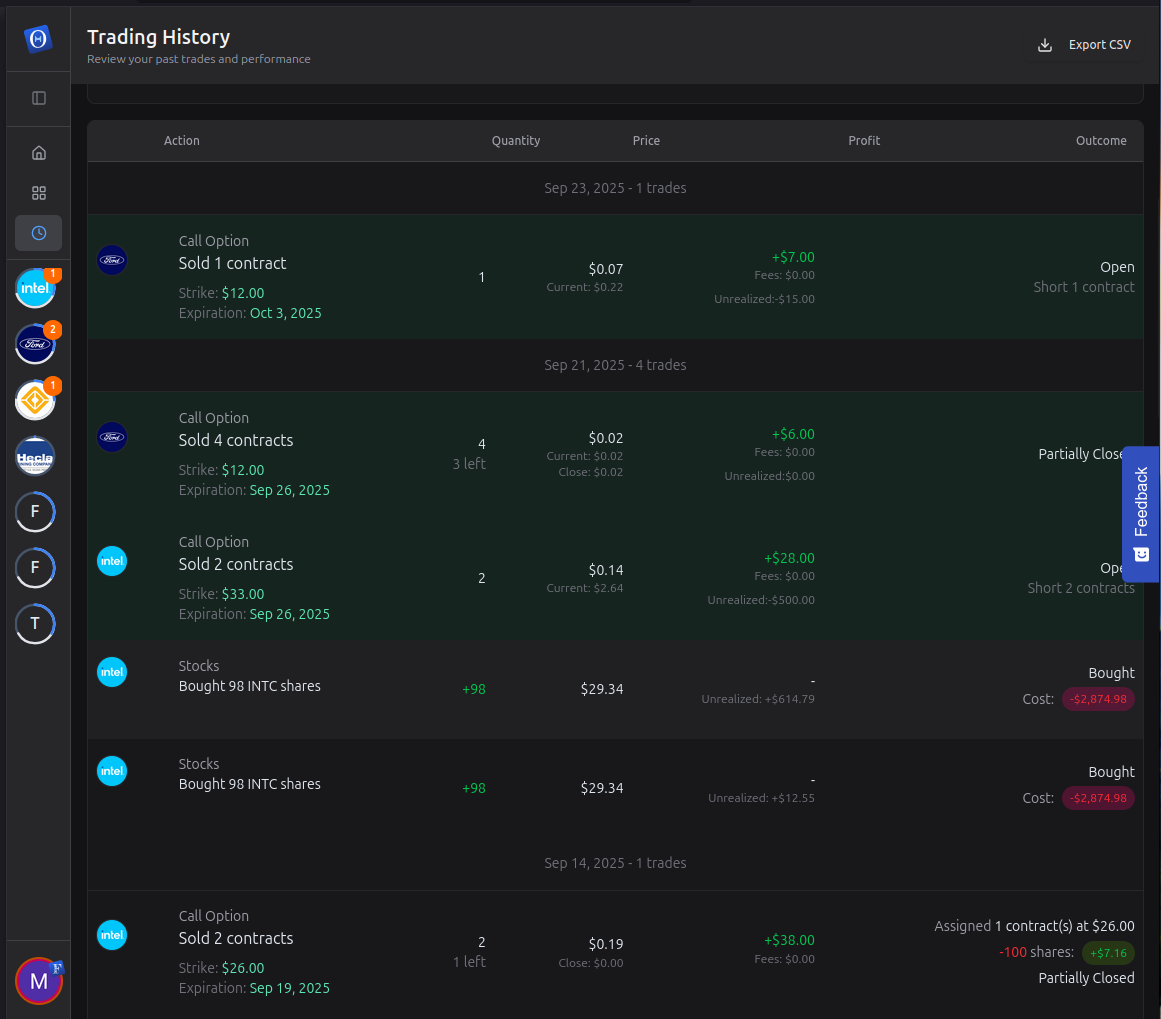

ThetaEdge doesn't just help you make trades, it helps you understand their impact. Our comprehensive tracking system monitors every covered call you sell, providing detailed analytics on:

- Portfolio-wide income: See your total premium income across all positions

- Position-specific performance: Understand which stocks are your best income generators

- Annualized yields: Compare your covered call returns to other income strategies

Whether you want a quick snapshot of this month's income or a deep dive into your performance, ThetaEdge presents your data in clear, actionable formats.

Stay Ahead with Intelligent Alerts

Never Miss an Opportunity

Markets move fast, but ThetaEdge moves faster. Our smart alert system keeps you informed without overwhelming you:

- New opportunity alerts: Get notified when market conditions create attractive covered call opportunities

- Position management alerts: Know when it's optimal to roll, close, or adjust your positions

- Assignment risk warnings: Stay ahead of potential assignments with proactive notifications

Receive the notifications that matter to you, when they matter most.

Powered by Real-Time Data You Can Trust

Every recommendation, every analysis, and every alert is backed by institutional-grade, real-time market data. We don't rely on delayed quotes or end-of-day snapshots. When market conditions shift, ThetaEdge adapts instantly, ensuring you're always making decisions based on the most current information available.

Who Benefits Most from ThetaEdge?

Stay Ahead with Intelligent Alerts

Never Miss an Opportunity

Markets move fast, but ThetaEdge moves faster. Our smart alert system keeps you informed without overwhelming you:

- New opportunity alerts: Get notified when market conditions create attractive covered call opportunities

- Position management alerts: Know when it's optimal to roll, close, or adjust your positions

- Assignment risk warnings: Stay ahead of potential assignments with proactive notifications

Receive the notifications that matter to you, when they matter most.

Powered by Real-Time Data You Can Trust

Every recommendation, every analysis, and every alert is backed by institutional-grade, real-time market data. We don't rely on delayed quotes or end-of-day snapshots. When market conditions shift, ThetaEdge adapts instantly, ensuring you're always making decisions based on the most current information available.

Who Benefits Most from ThetaEdge?

The Perfect Fit

ThetaEdge is designed for investors who:

- Busy Professionals: Want to generate passive income from their portfolios without becoming full-time options traders. Set your parameters, review opportunities on your schedule, and let ThetaEdge handle the monitoring.

- Long-Term Investors: Hold quality stocks they don't want to sell but want to monetize while waiting for appreciation. Generate income from positions you're already holding.

- Income-Focused Investors: Seek consistent, measurable returns through disciplined strategies rather than speculation. Build a reliable income stream without the stress of day trading.

- Risk-Conscious Traders: Want to enhance returns while maintaining control over their downside risk. Our risk management tools help you stay within your comfort zone.

Start Your Journey to Smarter Income Generation

ThetaEdge isn't just another investment tool, it's your partner in building a sustainable income strategy around the stocks you already own and believe in. Whether you're new to covered calls or an experienced options trader looking for a more efficient approach, ThetaEdge provides the tools, insights, and support you need to succeed.

Covered Calls can be Simple

Covered calls aren’t complicated - they’re one of the most practical ways to generate consistent returns from stocks you already own. The strategy is simple, effective, and proven.

At ThetaEdge, our mission is to strip away the noise. No jargon, no endless spreadsheets—just clear insights and tools that make covered calls accessible to every investor, from beginners to experienced traders.

Now it’s your turn to put the system to the test.

Join the Open Beta

We’re opening our platform to the first wave of users who want to:

- Experience covered calls without the confusion.

- See how AI-powered insights lower the barrier to entry.

- Turn passive stock ownership into a steady stream of income.

Join the Open Beta today and be part of shaping the future of smarter, simpler investing.